The Ultimate Guide To Offshore Company Formation

Table of ContentsThe Ultimate Guide To Offshore Company FormationOffshore Company Formation Things To Know Before You BuyNot known Facts About Offshore Company FormationOffshore Company Formation for BeginnersThe Main Principles Of Offshore Company Formation Some Of Offshore Company Formation

There are typically fewer legal obligations of managers of an offshore business. It is likewise usually easy to set up an offshore company and also the procedure is less complex compared to having an onshore business in numerous parts of the globe.If you are a business owner, for instance, you can produce an offshore business for privacy functions and also for simplicity of administration. An offshore company can also be made use of to lug out a consultancy company.

Offshore Company Formation for Beginners

The process can take as little as 15 mins. Even prior to creating an overseas business, it is first essential to know why you like offshore firm formation to setting up an onshore company.

If your main aim for opening up an overseas business is for privacy objectives, you can hide your names making use of candidate solutions. There are a number of points that you should bear in mind when choosing an offshore territory.

Offshore Company Formation Things To Know Before You Buy

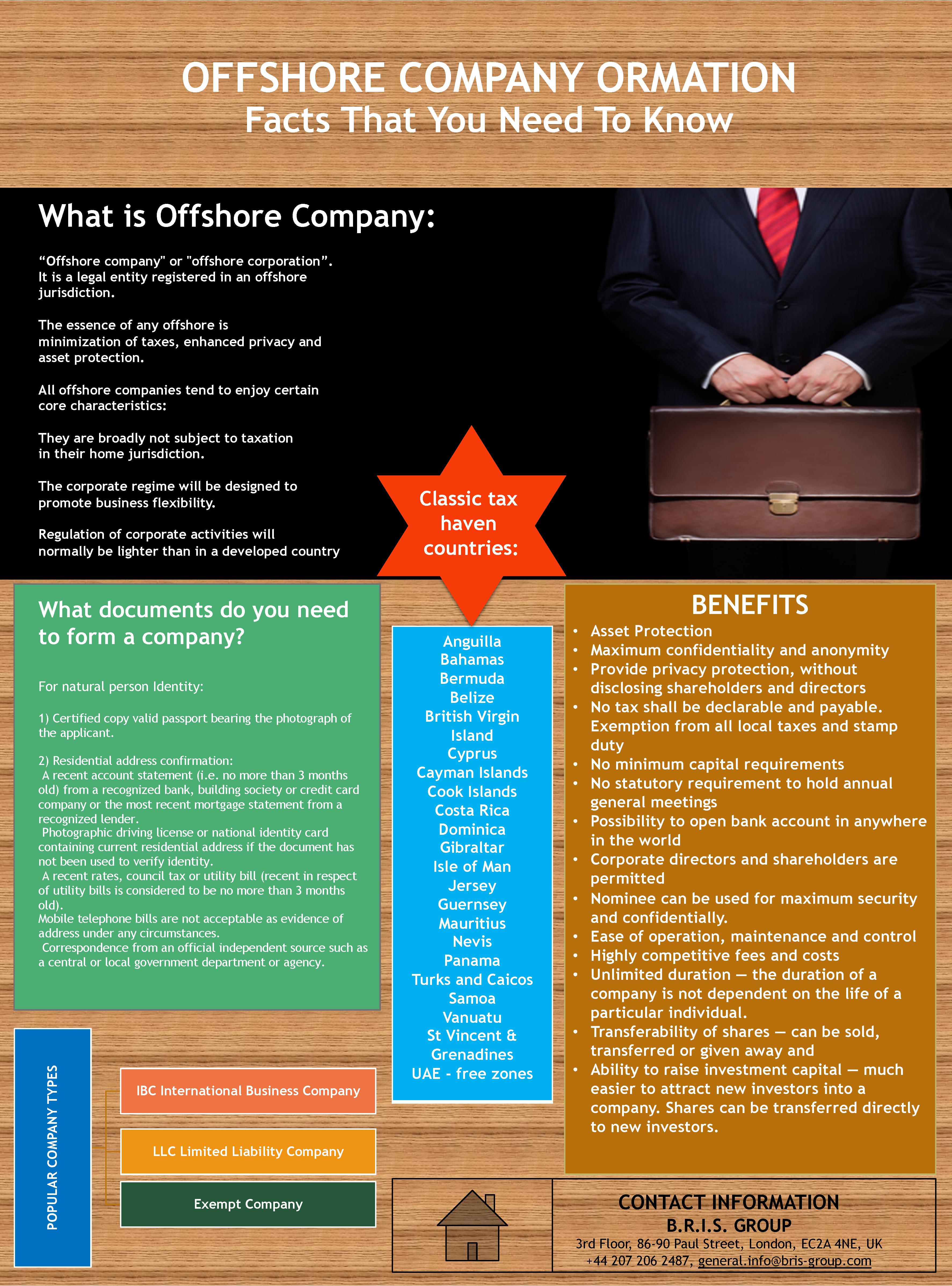

There are rather a number of overseas territories and the entire job of generating the very best one can be quite complicated. There are a number of points that you likewise have to take into consideration when choosing an offshore jurisdiction. Each region has its own special advantages. Some of things that you need to take into consideration include your residency situation, your organization and also your banking demands.

If you established up an offshore firm in Hong Kong, you can trade internationally without paying any kind of local tax obligations; the only problem is that you must not have an income source from Hong Kong. There are no taxes on capital gains as well as investment income. The place is also politically as well as financially secure. offshore company formation.

With a lot of territories to pick from, you can constantly locate the very best place to develop your offshore business. It is, nevertheless, essential to pay attention to details when thinking of your choice as not all companies will certainly enable you to open for savings account as well as you require to ensure you exercise proper tax obligation planning for your neighborhood along with the foreign jurisdiction.

Getting The Offshore Company Formation To Work

Corporate structuring and preparation have actually accomplished greater levels of complexity than ever while the need for privacy continues to be solid. Companies have to maintain pace and also be constantly looking for brand-new ways to benefit. One means is to have a clear understanding of the qualities of overseas international firms, and how they may be placed to advantageous use.

An even more proper term to make use of would certainly be tax mitigation or planning, since there are methods of mitigating tax obligations without damaging the law, whereas tax evasion is usually identified as a criminal activity. Yes, due to the fact that the majority of countries motivate worldwide trade and business, so there are typically no restrictions on residents working or having financial institution accounts in other nations.

The 7-Second Trick For Offshore Company Formation

Sophisticated as well as trusted high-net-worth people as well as corporations regularly use overseas investment lorries worldwide. Securing assets in mix with a Count on, an offshore company can stay clear of high degrees of revenue, capital as well as death taxes that would certainly otherwise be payable if the properties were held directly. It can additionally secure properties from lenders and also other interested events.

If the company shares are held by a Trust fund, the ownership is legitimately vested in the trustee, thus gaining the possibility for even greater tax obligation preparation benefits. Family Members as well as Protective Counts on (potentially as a choice to a Will) for buildup of financial investment income as well as long-term advantages for beneficiaries on a positive tax obligation basis (without revenue, inheritance or capital gains taxes); The sale or probate of buildings in different nations can come to be complex as well as expensive.

Conduct company More Bonuses without corporate tax obligations. Tax obligation places, such as British Virgin Islands, enable the development of International Firms my link that have no tax obligation or reporting obligations.

How Offshore Company Formation can Save You Time, Stress, and Money.

This permits the fees to accumulate in a low tax obligation jurisdiction. International Companies have the same civil liberties as an individual person and also can make financial investments, deal property, trade portfolios of stocks as well as bonds, and also perform any kind of lawful company activities so long as these are refrained from doing in the nation of enrollment.